Stale-dated Paychecks

Content

LegalMatch matches you to pre-screened lawyers in your city or county based on the specifics of your case. Within 24 hours experienced local lawyers review it and evaluate if you have a solid case. A lawyer can help you understand your rights and what actions you can take to protect yourself. If you have any questions or concerns, it’s always best to speak with a lawyer before taking any action.

What to do if check never cashed?

If a paycheck goes unclaimed for a certain period of time, you need to file and report it to your state. Each state determines when funds are escheatable. Generally, if a paycheck is unclaimed for one to five years, you will need to hand over the amount of the check to your state.

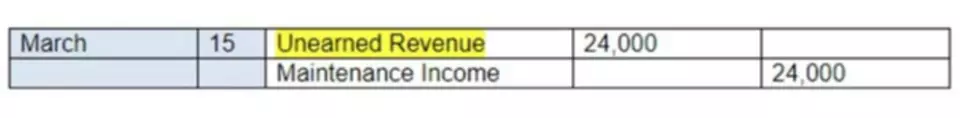

A common way to identify stale-dated checks is by reviewing regular bank reconciliations. This process highlights checks that haven’t been presented to the bank for payment or uncleared checks. Unless you have a government-issued check or certified check, it’s wise to deposit checks within six months.

Checking if the site connection is secure

BankersOnline is a free service made possible by the generous support of our advertisers and sponsors. Please help us keep BankersOnline FREE to all banking professionals. Support our advertisers and sponsors by clicking through to learn more about their products and services. When you receive a check from a governmental agency, read the check and look for anything that tells you when it expires.

If you found an old check made out to you, you should check with your bank and verify their policy. If you wrote a check that hasn’t been cashed, you may consider putting a stop payment on the old check. After that, you should contact the recipient of the check to see if they want a fresh check to replace the old one. Someone who wrote a personal check is probably not prepared for the hit their checking account balance will take if you cash it months later. Money orders don’t expire, but cashing in a money order late might cost you. The company that issued the money order could charge a nonrefundable fee that’s taken from the check amount if you don’t cash the money order within one to three years. Let’s say the opposite happens, and you are on the receiving end of a check that has expired.

Policies, Rights & Legal

We do not include the universe of companies or stale dated checks offers that may be available to you. The policy should more clearly outline what you are going to do if a recipient does not cash a check that you’ve issued. Without this information, it becomes much more challenging for your bank to process a stop payment. Keeping thorough records will go a long way toward ensuring business compliance. Almost every state requires a business to perform due diligence by contacting the owner of the unclaimed property. Payments Everything you need to start accepting payments for your business.

Federal Pell Grant Program Reconciliation Knowledge Center – FSA Partner Connect

Federal Pell Grant Program Reconciliation Knowledge Center.

Posted: Thu, 09 Feb 2023 14:30:51 GMT [source]

https://www.bookstime.com/ is unsuccessful a second attempt will occur after 120 days. The second attempt letter will notify them that this is their last notification before turning the money over to the State of New Hampshire Abandoned Property.